The economics rule of “high risk, high returns” fits perfectly with the case of hedge funds. Despite being one of the riskiest options to invest in, hedge funds also provide some of the best returns on investment.

Hence, the field is attracting so much demand among investors, and so people are craving more and more to get their hands on them. As a result, the tech space has gained interest in the domain and gradually, you can see various innovations happening.

As per the 2023 report of PwC on hedge funds, more than 80% of the hedge funds have adopted artificial intelligence in their operations. Thanks to that adoption, the accuracy of their decision-making and annual returns has increased up to 15%.

Likewise, various other innovations are claiming their place in hedge funds and are making their efforts in full color.

Read this article till the end to find out how the sector is evolving day by day.

Data analytics and big data are nowadays present in almost all sectors. Hedge funds usually source their information on hedge fund data providers that deal in the sector. Apart from that, here is how they play their role:

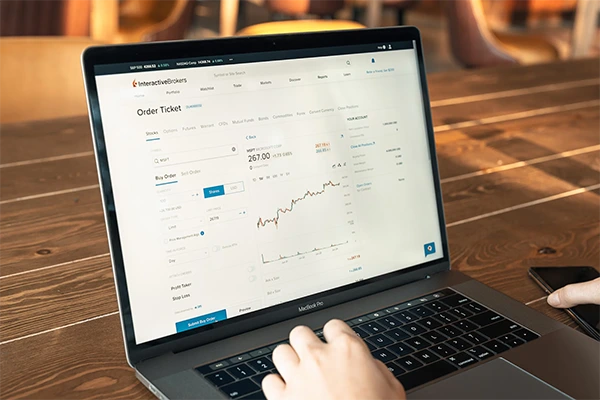

Diving deeper into how algorithm trading and machine learning are leading the change, both techniques are key contributors to making investing easy. This is how they are used:

This is how both modern tech innovations contribute to making hedge funds simpler and more profitable.

Cloud computing is all about efficiency, convenience, speed, and innovation. Here is how cloud computing is beneficial:

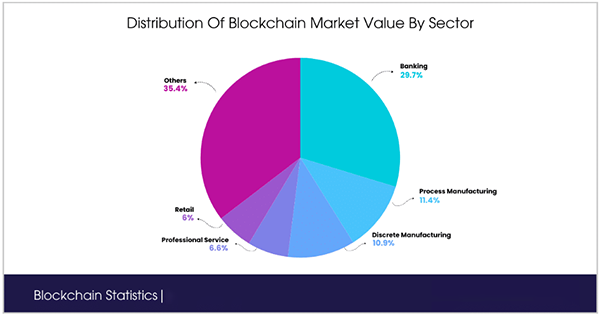

In order to keep all the information safe and sound, blockchain technology is making its contribution to a significant amount. It ultimately aims to streamline operations by enhancing transparency, security, and efficiency.

Blockchain’s tech works on a decentralized structure. This means, there is no central body that governs the operation of the tech. Hence, the information and programs are stored on numerous levels. So, it becomes even more complex to hack the data.

These are the various sectors in which blockchain is used on different levels.

Robo-advisors and automated investment strategies are no less than AI and ML. At their core, they all are aimed to make hedge funds more reliable and profitable while simultaneously keeping them trustworthy investment options.

These techs help with the following responsibilities:

This way, hedge funds are made more trustworthy and profitable for the investors.

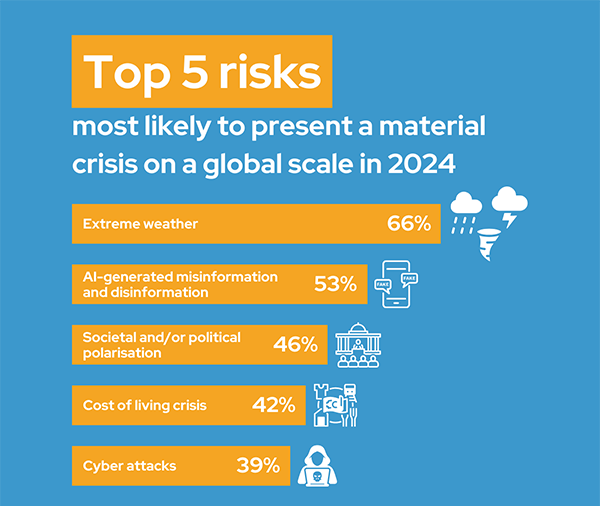

For any business with a long-term survival goal, risk mitigation is more of a necessity. Hence, artificial intelligence is turning out to be one of the best ways to do it.

These are the top 5 risks that a business is most prone to, respective to their fields of operations. How AI is helping firms to stay safe from these risks is pretty simple.

With analytics like predictive analysis, sentiment analysis, and various other metrics, the hedge funds are made secure with the maximum risks possible.

For promoting a culture of transparency and accountability, better communication and collaboration tools are necessary. These tools ensure all the information and messages are shared within a flash, that too, with complete safety.

They help in:

With all these functions and features, firms or organizations rely heavily on these tools.

Lastly, cybersecurity is a requirement that is necessary in almost every sector of the world. Be it tech-related, management-related, or even on an individual level, cybersecurity is indispensable. In the case of hedge funds, they usually deal in tons of information and critical data that might make or break the future of numerous investors.

Hence, modern solutions of cybersecurity are implemented in organizations of these funds to ensure top-notch security and safety of the user data.

Hedge funds are performing more efficiently and effectively day by day. With more tech integration into their daily operations, organizations are finally providing better returns on people’s investments.

This article discussed all those tech pieces that are making their contribution to advancing the domain, hence, share it with your friends or team who are also interested in learning about hedge funds.