It’s a customer argument to reverse a payment.

“Every click to ‘buy’ or ‘subscribe’ to a streaming plan looks instant – but that second lies many traps of fraudsters, fake identities and failed payments”. Even a single weak link can cost money, lose trust and shut down businesses overnight.

If this seems like too much to happen, look at the Juniper research – “Losses due to global online frauds are predicted to reach about $206 billion by 2025”. And this number will keep increasing if the right practices aren’t adopted.

To stay ahead, we need to understand regulatory landscapes, technical payment foundations, fraud risk mitigation and then build a best practice checklist that covers every aspect of it.

Let’s get started on the fraud prevention and risk management journey –

Before any transaction occurs, some rules are applied and some layerings get stronger. Let’s understand –

In the digital entertainment space, licensing, AML (anti money laundering) and KYC (know your customer) are not optional anymore – they are the foundations of operations.

For instance, failing to verify a user can flag suspicious payments and add regulatory fines.

These rules shift with locations – many markets require local licences for gaming platforms, while others require advanced AML screening even for micro-transactions.

Ignoring them is like driving with Google Maps without recognizing local traffic laws.

Handling international transactions across the globe includes three main barriers:

Every payment gateway for online gaming should handle exchange rates, settlement timings and bank routing costs. For example: every user will pay in their own currency.

Without local payment options, conversion rates suffer. As not every country uses credit cards, bank transfers and others.

These frauds are very common. As per global reports, digital fraud attempts rose 80% from 2019 to 2022. And it directly hits the revenue.

Every global transaction is like a train journey, has multiple tracks (currencies), various types of tickets (payment options) and constant risk of derailment (frauds/charges).

Once the regulatory foundations are understood, next comes the technical one –

In online gaming environments, platforms must ensure encryption, tokenization, PCI-DSS compliance and robust fraud screening during authorization.

Platforms can choose a fully embedded API or a hosted payment page. Hosting limit UX and API increases implementation complexity.

Many operators from the Payment Card Industry (PCI) operate on recurring models. Every decline or failed payments require logic. Every missed renewable means a dissatisfied user.

These gateways are the airbags of the transaction systems – if they are built weakly, the impact of the crash (fraud or failure) will be high and more visible.

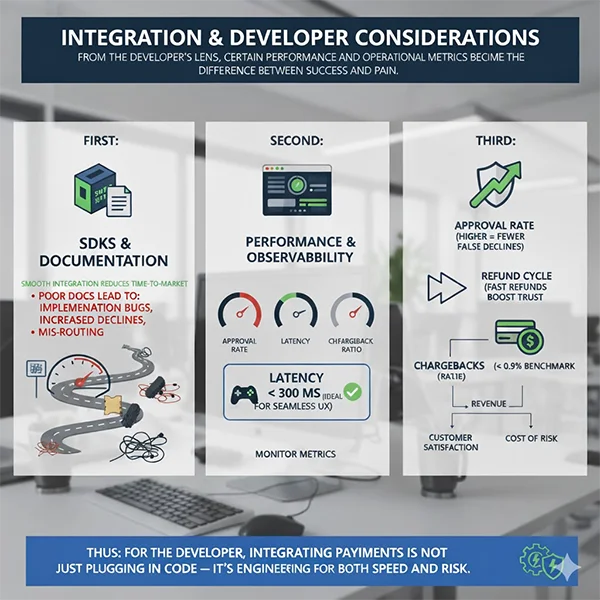

Effective integration requires a lot of planning and developer considerations. You must provide the developer with the right tools and resources to implement solutions seamlessly across various platforms. The infographic below explains this point in more detail. Take a look!

ANALOGY

The most profitable gaming platforms treat payment gateways like engines — regularly checked, maintained and optimized.

Risk doesn’t wait for you to catch your breath. Here are the two efficient ways to manage it:

This uses machine learning and anomaly detection to avoid users with suspicious patterns in real-time. For instance – unusual device fingerprinting.

This helps platforms to understand the root cause of chargebacks – saving cost and reputational damage.

A mid-sized online gaming operator noticed its chargeback rate growing to 1.2%. By implementing an ML model that flagged high-risk transactions, they reduced the chargeback ratio to 0.75% within 6 months – saving thousands of dollars.

Risk teams don’t just react – they build systems that learn from their own.

Operator Insight

Operators who track approval rates, delays and chargebacks – monthly see upto 15% higher transaction success and fewer drop-offs.

Tailoring payment experience to other markets, including local ones, is both an opportunity and a requirement.

It simply means offering local payment methods to users. For example – UPI in India and PIX in Brazil. Failure to provide so can increase decline rates.

Even after providing a smooth payment gateway, familiar flows in UI/UX are essential for higher satisfaction rates. A generic one can give a strong hit to conversion.

The payment process should feel smooth to boost conversion and reduce user abandonment risk.

Fraud prevention in digital entertainment isn’t about finishing a checklist – it’s a continuous discipline. As transactions scale, managing risks becomes more complex. In this, the winners will be those who treat risk as architecture, not a postscript.

Ensure strong gateways, monitor in real-time and offer every local transaction – you will be safe from risks and frauds.

It’s a customer argument to reverse a payment.

It uses AI (artificial intelligence) and ML (machine learning) to analyze huge datasets.

It is a set of security standards that are mandatory to protect user data and details.