In 2013, Plaid was founded by Zach Perret and William Hockey.

Nowadays, it is quite common to manage bank accounts by utilizing multiple applications. But have you ever faced a situation where you have downloaded a payment app such as Venmo, M1 Finance, WorldRemit, and the rest that might ask for access to your all confidential financial info powered by Plaid? However, it makes you wonder is Plaid safe.

Your concern is valid; trusting a third-party app for your financial details is quite vital. Here in this article, you will comprehend the complete guide regarding this platform, where you will get all the detailed answers to your queries “What is Plaid and is it safe?” Without further ado, let’s get into the details concerning Plaid.

Plaid, a fintech company cited as one of the established digital financial technologies, that numerous organizations trusted. It was founded by two experts named, Zach Perret and William Hockey in 2013.

The main objective of this platform is to provide you with a data network that will assist in connecting your financial account to third-party apps to enable their further service faster, and more securely, resulting in an uncluttered financial experience.

Moreover, the Plaid app assures you the complete security of your confidential data with its unparalleled protocols that have been consistently developing and becoming challenging against all cyber threats.

Let’s explore the comprehensive guide of Plaid, to resolve your queries and concerns regarding this platform.

Fun Fact

No, Plaid is not meant for the kids, you must be at least 18 years old to operate any financial account. This platform is a setup for connecting your bank account to further applications. But Plaid, in their privacy and security policy, states that they do not collect or track a record of a child under the age of thirteen.

It is a secure fintech app that has access to your sensitive information; handing control of the platform to a child won’t be appropriate. You must be careful with your financial app and keep it away from your child’s reach to overstep any kind of security breach.

You might be worried about your digital financial data and wonder if this platform is safe to use or if is Plaid legitimate. Then there is the accurate answer to your doubt, and that is yes, this platform is legit and 100% safe to use. It offers spectacular security and robust encryption plans to safeguard your data while utilizing third-party apps.

This fintech company endorses the principle that you have a complete right to your financial information, and only you can decide where, when, and how to share your confidential data. It will never share your information unless you permit it to do so.

This platform utilizes several security tactics to protect your digital footprints. Let’s see them one by one.

Multi-factor authentication (MFA) has been implemented to furnish an additional layer of authorization besides the username and passwords to secure the internal system. This assists in blocking access to your data by any further malicious user or server.

To host the Plaid API and further related components, this platform has built its infrastructure based on the cloud. The service provider of the cloud that Plaid has utilized, develops and strengthens its security measures and enhances its technology’s flexibility consistently to avoid any sort of lapse in security incidents.

Comprehensive monitoring is a key feature consistent in this platform’s strong security plans. Following this, the platform assists you with complete monitoring by which they will automate alerts and 24/7 call team support to discover and resolve any sort of glitch or fraud in the meantime.

To establish an exceptional security program, many experts, including security researchers, developers, and financial institutes repeatedly test the Plaid API and security controls to step aside any further loopholes. The platform also performs a bug bounty program that is also disclosed to the public so that you can use this measure to ethically present your query for a bounty in the meantime.

Thus, these are some essential tactics practiced by the Plaid to grant profound security and protection to your digital data.

After getting the assurance of the safety of this platform, you might also be contemplating what and how it handles your information. Do not worry, here we have further clarified what sort of information is obtained by this platform and how it is managed.

There are numerous pieces of information stored on its server while you are operating the apps. We have listed them below, let’s take a look.

The platform has been transparent about the data they have collected on their server from the start. It ensures that strictly necessary data has been stored by them to enhance your experience in the digital financial landscape. Also, it builds and operates the product that sets the limitation on their server while tracking your data, by which no further confidential data has been collected in the Plaid server.

Additionally, you can visit the Plaid portal to overview the data that has been shared through its server and control the access of the platform to your information.

Using this application for managing your finance account effortlessly is not hectic anymore. By following some simple steps you can operate Plaid easily such as:

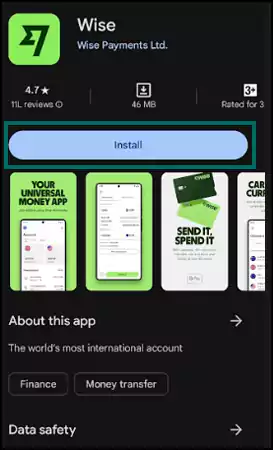

Here, we are taking the example of the Wise app.

Hence, adhering to these steps will easily assist you in safeguarding your digital financial account by Plaid.

There are tremendous amounts of established organizations that have teamed up with Plaid, to connect their user directly to them while using third-party apps. Let’s take a look at their names, which are mentioned below.

Therefore, the above-mentioned apps are examples of some apps that are powered by Plaid.

Disclaimer: All these apps are third-party and prone to financial risks, so consider using them at your own risk or adhere to the privacy policies and terms and conditions of the same.

On the whole, Plaid, a fintech company, makes itself authentic by implementing robust security measures, transparency, and user control features, which also make it safe and reliable for you in the financial technology landscape.

It has become one of the trusted and essential tools for managing financial data, you can depend on it just like the other official organizations are, without stressing about the security of your bank account information and personal datasets.

In 2013, Plaid was founded by Zach Perret and William Hockey.

Yes, you can trust this platform completely, and you can freely utilize it to connect your bank with further apps.

There are numerous information collected by the platform, including your transaction details, account summary, and account credentials.

It is a legitimate fintech company, that is 100% safe to use for your banking activities.

Venmo, a payment app that uses this platform to maintain its security, is completely safe to utilize.

Yes, the platform is entirely safe to use.