Technology keeps everything in check and provides real-time insights, expense management, and new innovative financing solutions are introduced.

KEY TAKEAWAYS

- Advanced technology has streamlined the cash flow management process.

- Cloud-based solution keeps data organized and accessible for everyone.

- Automation eliminates time-consuming, repetitive tasks.

- The Internet of Things (IoT) keeps inventory in check and sends reminders when there is a lack of stock.

- Encryption and blockchain keep sensitive information safe.

“Never take your eyes off the cash flow because it’s the lifeblood of business.”

—Sir Richard Branson (English business magnate)

Cash flow management is the most crucial aspect of a business. According to Wikipedia. “Cash flow, in general, refers to payments made into or out of a business, project, or financial product. It can also refer more specifically to a real or virtual movement of money.”

However, the traditional method has its drawbacks, and in this fast-paced world, businesses have started to look for alternatives that are reliable and get things done on time, and advanced technology turned out to be the perfect solution.

In this article, I’ll mention how advanced technology is transforming traditional cash flow management by streamlining all its areas.

Traditional cash flow management came with several limitations. While most businesses have adopted the latest technology, some still rely on the old methods to track cash flow by using paper-based documentation and spreadsheets.

The traditional process is time-consuming because entry and calculation are done manually. This also leads to human error, which can further create chaos in the financial draft of financial reports and cash flow forecasts.

Future cash flow trends can’t be predictive as there is no way to get insights and determine something, and visibility is also limited as getting a time view of cash flow is hard to get. These are just some of the limitations that have made corporations switch up to technological solutions.

Cloud-based software has brought some major changes in how data is stored and analyzed. Several platforms and services allow companies to manage their financial data online. These are quite easy to access and can be accessed from anywhere, from a remote location or office.

This approach ensures that the crucial data is always at your fingertip. Real-time monitoring and updates also become easier, and businesses can keep tabs on inflows and outflows continuously. Predicting future trends and making strategies accordingly becomes seamless.

Collaboration is also facilitated among team members as they all can share financial information. Decisions that are made after that consist of everyone’s thoughts and opinions.

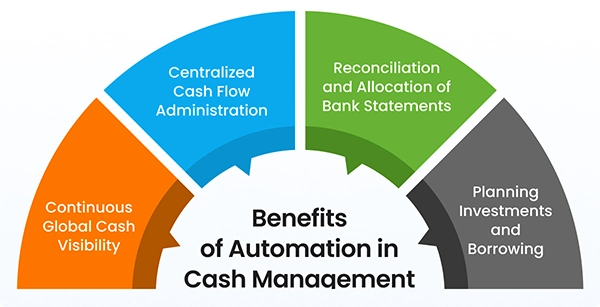

Automation has been revolutionary, playing a crucial role in every sector. They can handle repetitive tasks, saving valuable time and resources that can be used further on other important work. Below, you can see several benefits of automation.

Individuals also have more time to make better strategies by analyzing cash flow trends. The cash flow process is streamlined with automation, and issuing invoices, sending payment reminders, and reconciling accounts are less challenging than ever.

Human error was a major concern, but automation has reduced it to zero and made reporting/analysis more accurate. For example, solutions like Invoice Fly can automate invoicing processes, providing templates for invoicing, payment tracking, and financial reporting.

This not only speeds up the billing cycle but also allows for quicker payment collection, thus improving cash flow.

Data analytics ad reporting remains a crucial aspect of any business, and it has been improved significantly with the integration of advanced technology. There are specialized predictive analytic tools that forecast cash flow trends with the help of historical data and current market situations.

Firms can be prepared for any potential downfalls along with a strategy that can counter it. Generating detailed reports with comprehensive reporting can highlight areas of improvement and show where funds are being used and misused.

These can be customized so they meet the requirements and needs of a corporation. Real-time monitoring is also possible because of enhanced data analytics, and those who are in authority will receive instant notifications related to cash flow issues, allowing them to react quickly and effectively.

Integrating the financial management system with cash flow management tools has significantly improved the cash flow process. For example, when merged with enterprise resource planning (ERP) systems and accounting, it creates such a dynamic view that makes all the financial information organized and easy to access.

Integrated systems allow automated data transfers, which reduces errors and keeps it reliable for firms to maintain legitimate financial records. Interaction between different financial processes also becomes smoother.

Many might wonder what the Internet of Things (IoT) has to do with cash flow management. IoT devices are known for tracking inventory and can send signals if there is stock shortage or unavailability.

Organizations can maintain better cash flow management as they’ll be aware when to reorder or clear inventory. Supply chain management becomes more effective as owners can monitor it with IoT technology.

It can identify disruptions and delays that majorly affect cash flow management. They can stay prepared and make adjustments accordingly.

There are new payment options available for customers that are streamlining cash flow management with digital payment solutions, which is convenient and faster. Customers can pay invoices via credit card, debit card, bank transfers, or digital wallet. This promotes flexibility. Since it’s quicker, improved cash flow is recorded.

The entire transaction experience has been modified with integrated payment systems as it sends notifications and reminders on time, which helps get payments on time. Mobile is part of everyone’s day-to-day life, and customers can easily pay using their digital wallets without any unnecessary steps and from their comfort.

Most things are now being done digitally, which makes security the number one priority. But there’s nothing to worry about because encryption and blockchain provide a secure environment, keep all the sensitive data in check, and don’t let anyone breach in.

AI-driven analytical tools are quick to identify suspicious payment patterns that might be a part of any fraudulent activity. It becomes easy to track, and businesses can take protective measures and save their cash flow management.

DID YOU KNOW?

The cash flow management software market was valued at $0.4 billion in 2020 and is expected to reach $1.2 billion by 2025!

Advanced technology has eliminated all those issues related to cash flow management that used to occur in traditional methods. New methods have been introduced and integrated that have made the entire process streamlined.

Data analytics can predict market trends, and automation can save up a lot of valuable time on repetitive task. The Internet of Things is keeping things in check, and customers have more options to make payments.

Overall, it has been beneficial for both the corporations and those using their service. It is safe to say that more advancements will be introduced in the future and will make cash flow management even better.

Technology keeps everything in check and provides real-time insights, expense management, and new innovative financing solutions are introduced.

The traditional cash flow approach ensures that more money is coming in than going out. It’s ideal for both small and large businesses, but is time-consuming and prone to manual errors.

Focusing on forecasting, managing payable, streamlining process with advanced technology are some of the intelligent ways to control cash flow.